FAQ’s

Would East Hampton Town residents see taxes rise?

YES. According to the H2M Report-Rev 2, all East Hampton town residents (not just Montauk) would be paying for the construction, maintenance and services of the infrastructure and buildings as well as debt service on the $75 million bond for the initial buildout.

According to the H2M Report-Rev 2, section 6.2 a new department in the towns public works department (DPW) would need to be created. The new division of DPW would require, at a minimum, a full- time Superintendent to perform managerial functions required to oversee the sewer district. In addition, at a minimum two full-time employees would need to be hired by the Town and dedicated to the district to perform general maintenance activities within the collection, conveyance, and treatment systems primarily consisting of equipment repairs as needed. These numbers would almost certainly increase!

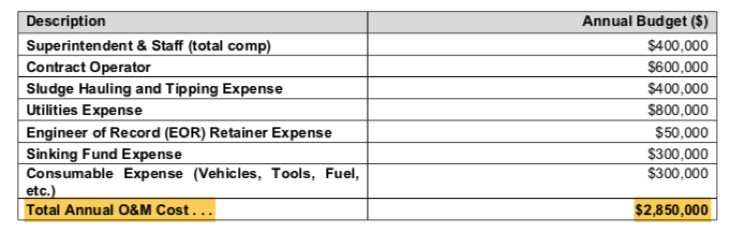

According to the H2M Report-Rev 2, Table 6 the East Hampton Town annual operating & maintenance budget for the facility would be just under $3 million

H2M Report- Rev 2, Table 6: Operational Costs

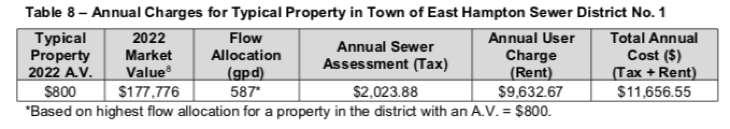

The tax levy for a typical Montauk property within the sewer district would be an additional $2023 in taxes plus $9632 for user fees, totaling a staggering $11,656

H2M Report- Rev 2, Table 8: Annual Charges

© 2023 Whalenworks LLC

Design by Whalenworks, all rights reserved

© 2023 R.E. Whalen, photos used by permission

All photos ©copyright R.E. Whalen, used by permission